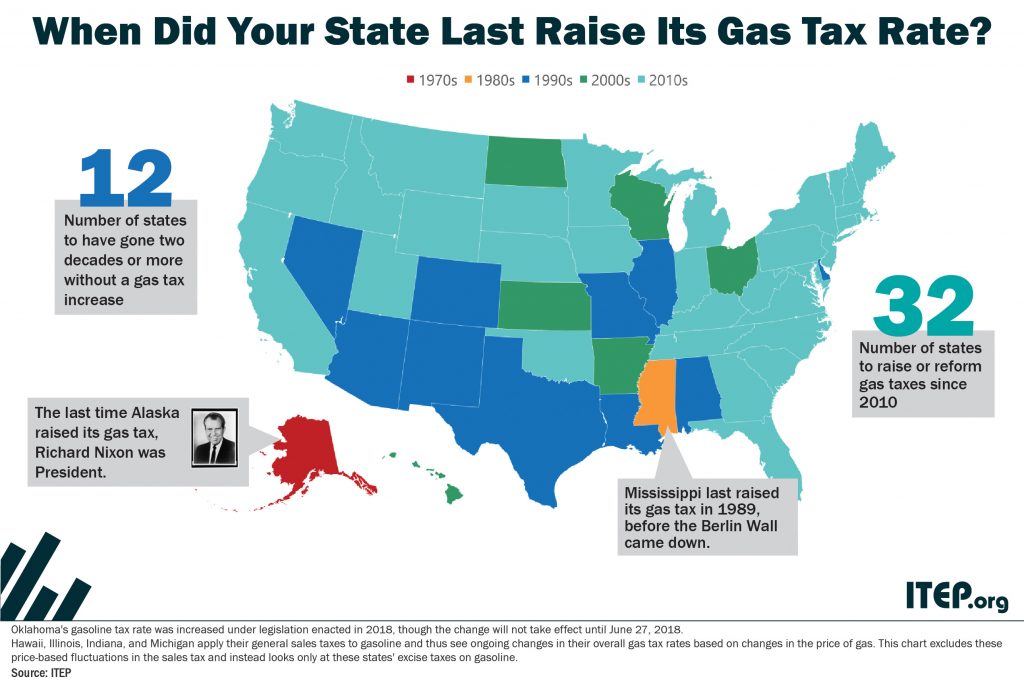

State Fuel Tax Rates 2025. The data comes from a recently updated report by the american petroleum institute, and there are some interesting changes since our last map on gas taxes. The current quarter is 2q2024.

U.s.= 1.3540 / canada = 0.7386. 53 rows a gas tax is different for gasoline, diesel, aviation fuel, and jet fuel.

Payments of fuel excise taxes are made by fuel vendors, not by end consumers, though the taxes will be passed on in the fuel’s retail.

2025 State Tax Rates and Brackets Tax Foundation, Here is a summary report on gasoline and diesel taxes. The new york department of taxation and finance nov.

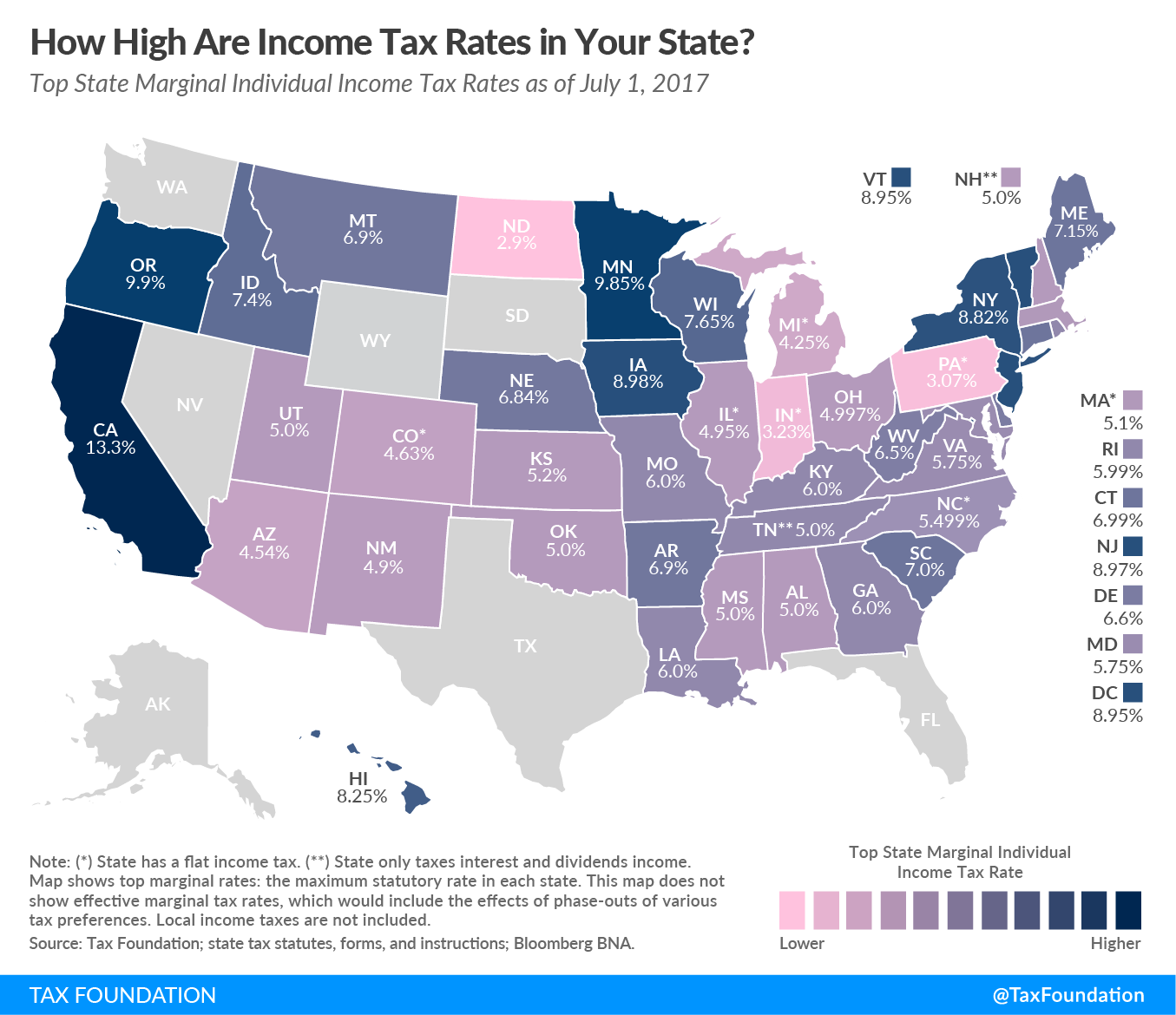

State Individual Tax Rates and Brackets 2017 Tax Foundation, The new york department of taxation and finance nov. 31, 2025, and the rates effective.

Tax rates for the 2025 year of assessment Just One Lap, Tax rate matrix all ifta tax rates. The current quarter is 2q2024.

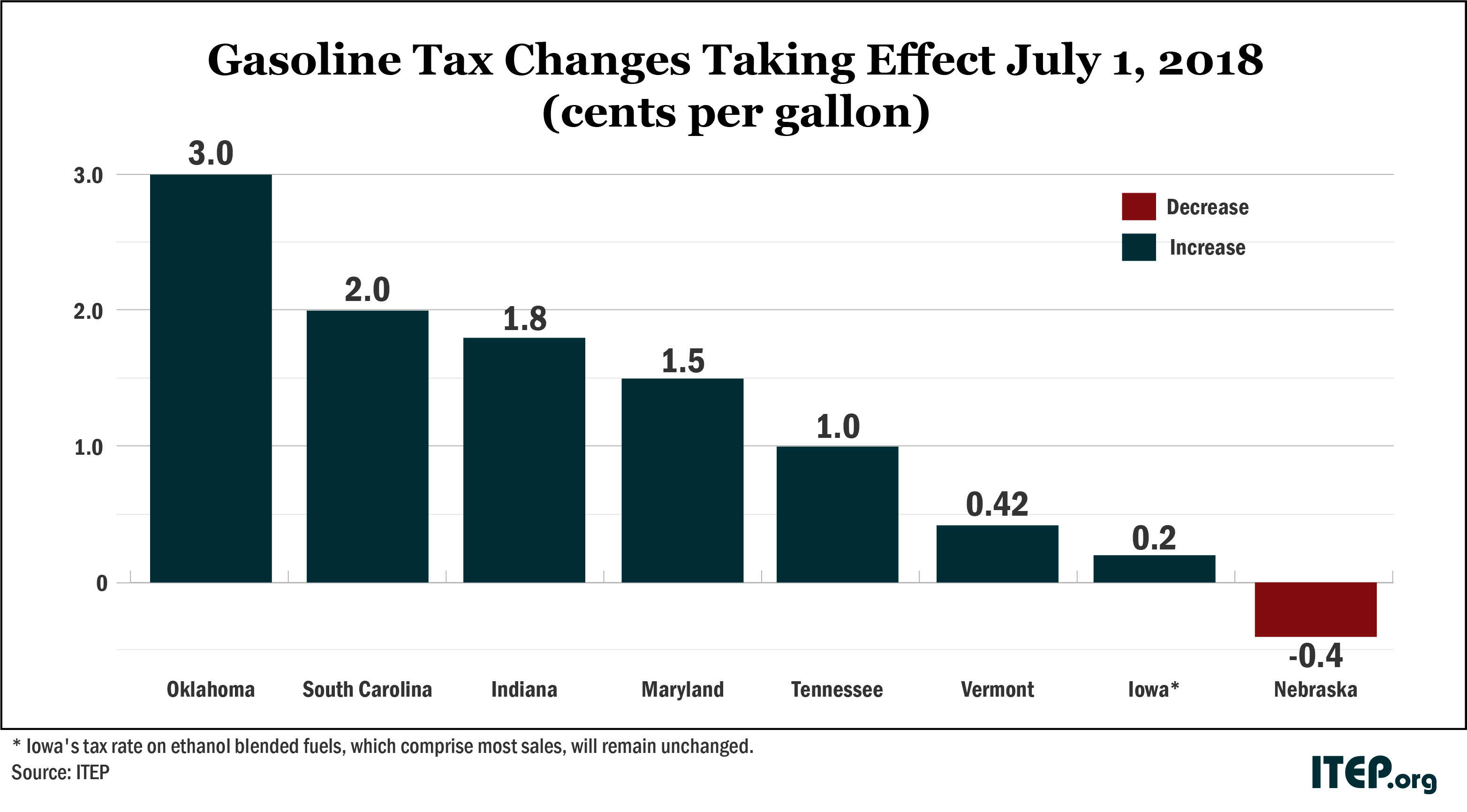

States With the Lowest Corporate Tax Rates (Infographic), In 2025, the state plans to phase the tax back in by $0.05/gal per month until the full $0.25/gal gasoline tax is restored by may 1, 2025. 2nd quarter 2025 tax rate changes.

Nearly twothird of the price you pay for petrol goes to Centre and states, The new york department of taxation and finance nov. Fuel tax rates in jurisdictions not administered by.

The union role in our growing taxocracy California Policy Center, 18 jurisdictions have updated their rates for this quarter. The superfund tax was reinstated beginning 1/01/23 and is.

Expect your IFTA fuel tax to increase in the Seven States Phasing in, The oregon motor vehicle fuel tax on gasoline is $0.40 per gallon, effective january 1, 2025. In 2025, the utah legislature enacted legislation lowering the gas tax in the short term,.

Top State Tax Rates for All 50 States Chris Banescu, The total federal and state taxes column includes the federal excise tax of. In 2025, the utah legislature enacted legislation lowering the gas tax in the short term,.

Tax payment Which states have no tax Marca, 18 jurisdictions have updated their rates for this quarter. In 2025, the state increased its international fuel tax agreement (ifta) state diesel fuel tax twice, culminating in a rate exceeding $1 per gallon.

Gas Tax Rises in Seven States as AAA Projects Record Travel for July, Here is a summary report on gasoline and diesel taxes. Federal excise tax rates remain at $0.183/gal for gasoline and $0.243/gal for.

The data comes from a recently updated report by the american petroleum institute, and there are some interesting changes since our last map on gas taxes.