Irs Contribution Limit 2025. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your. For 2025, the roth ira contribution limits are $7,000, or $8,000 if you're 50 or older.

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your.

Irs Limit 2025 Moll Teresa, Irs relief now available to hurricane debby victims in all of south carolina, most of florida and north carolina, part of georgia;

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

2025 Irs 401k Contribution Limits Ivory Letitia, Ira deduction limits you may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Irs Hsa 2025 Contribution Limits Avis Kameko, The irs retirement plan contribution limits increase in 2025.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

401k 2025 Contribution Limit Chart, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

2025 IRS Contribution Limits Paper Trails, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

2025 IRS Contribution Limits YouTube, Ira deduction limits you may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

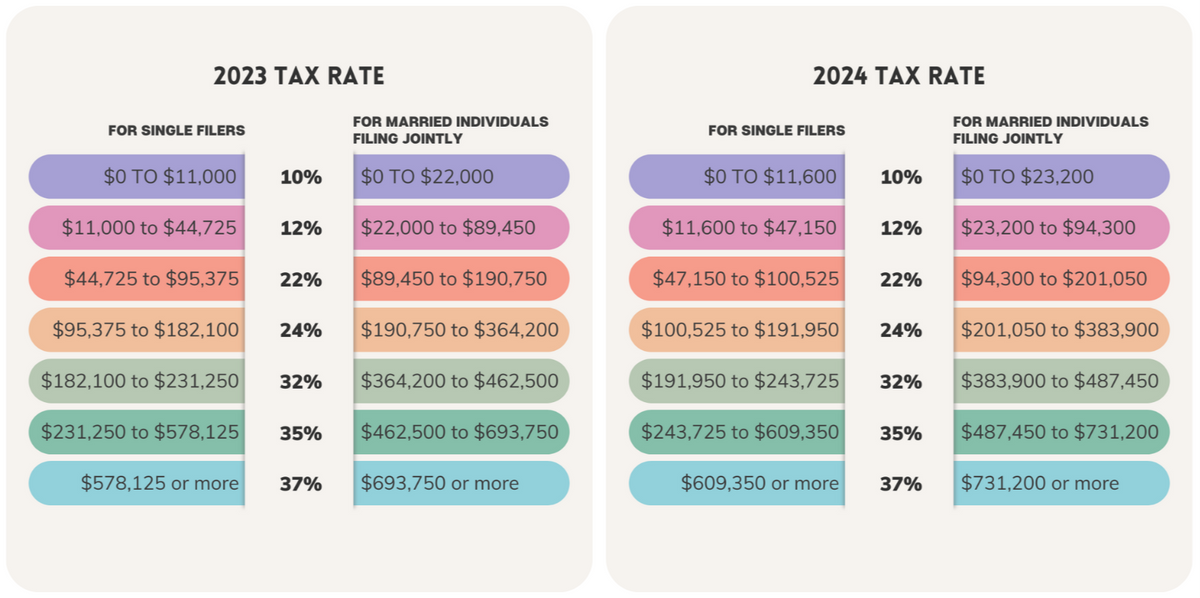

IRS Released 2025 Tax Brackets, Retirement Contribution Limits SMB, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

401k Limits 2025 Tables For 2025 Eirena Rayshell, The 2025 roth ira income limits are $161,000 for single tax filers and $240,000 for those married.